Review and upload loan application documents

About loan application documentation

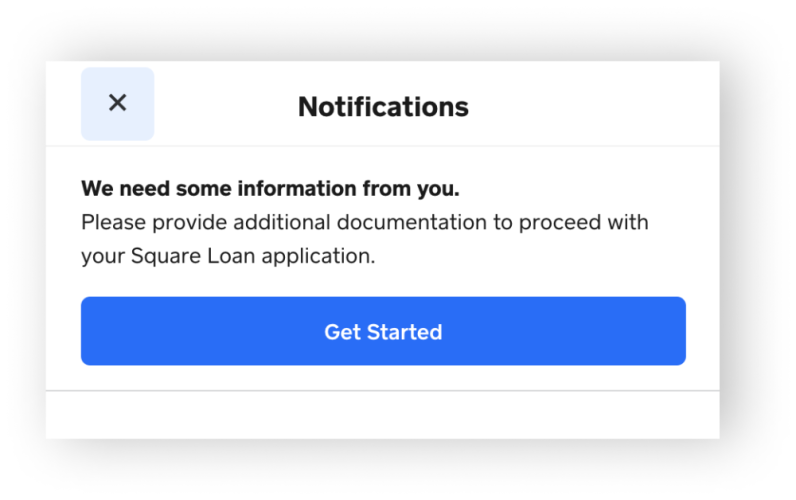

When applying for a Square Loan, your business name and taxpayer information will be used to verify you and your business. Typically, you’ll be notified of your application status within one to three business days. If you don’t receive a decision within this timeframe, additional information may be required to verify personal or business details. If so, you’ll be contacted through your Square Dashboard and via email to provide additional documentation.

Before you begin

If additional documentation is requested for your loan application, the information is needed in order for your application to move forward. Your loan application cannot be reviewed if the request is incomplete.

Complete the request in full to the best of your ability. If the submitted information isn’t sufficient, you will be contacted via email and your Square Dashboard with additional details.

Square Loans are underwritten and issued by Square Financial Services, a Utah-Chartered Industrial Bank, Member FDIC.

Review accepted application documents

If we are unable to verify your legal name, Social Security number and/or date of birth, we may request:

- A government issued ID, such as a driver’s license or passport

- Social Security card

- A recent personal tax return

- Individual Taxpayer Identification Number (ITIN) letter from the IRS

If you don’t have a government-issued photo ID to verify your date of birth, you can submit one of the following documents:

- Birth certificate

- ITIN Letter

- U.S. Certificate of Naturalization (Form N-550)

- Employment Authorization document (I-668B or I-766)

- Military ID

- Tribal-issued photo ID

- DHS trusted traveler cards

If you can’t submit a copy of your Social Security card, you can submit one of the following documents along with your government-issued ID:

- Most recent personal tax return

- Individual Tax Identification Number (ITIN) letter from the IRS

- W-2 tax form

- Military Discharge documents

- Unemployment Benefits letter

Please be sure the document clearly displays your full legal name and Social Security number.

When applying for a Square Loan you need to provide your TIN for business verification purposes. Provide the following documentation based on your business type:

- Sole proprietor: Social Security number (SSN) or Individual Taxpayer Information Number (ITIN).

- Limited Liability Company, Partnership, C Corporation, or S Corporation: Employee Identification number (EIN).

- Single Member LLC: The business owner’s SSN or the business’s Employee Identification Number (EIN).

If we are unable to verify your legal business name and/or TIN, we may request one of the following:

- Your business’s government issued SS-4 or EIN confirmation letter

- Your most recent business tax returns confirming your business name and TIN

- Secretary of State documents that contain your business TIN

If you misplaced your SS-4 confirmation letter, call the IRS and reach their Business and Specialty Tax Line at 800-829-4933. For additional tips, visit the IRS online.

If you are a Single Member LLC and don’t have an EIN please clarify your entity type in the information request and submit a copy of your most recent Schedule C (Form 1040).

If you’re a sole proprietor, your business name is the same as your first and last name and your TIN is your Social Security number. Some sole proprietors may also register DBA (doing-business-as) names. If you have a DBA, you’ll be asked to provide it in the application. You can find out your business entity type from your tax returns.

Depending on your business type, beneficial owners or business managers who are a part of your business may need to be verified. If the information provided for any of the listed beneficial owners or business managers can’t be verified, one or more of the following documents may be requested:

- Social Security card

- A recent personal tax return

- Passport

- Individual Taxpayer Identification Number (ITIN) letter from the IRS

If additional information about your business is needed, you can submit one of the following documents:

- Articles of incorporation

- Tax return

- Articles of organization

- Secretary of State business registration

- Business license

If you are a sole proprietor, you may be asked to submit a copy of your government-issued ID and your Social Security card.

If we’re unable to verify the business address, a utility bill may be requested for your business. The document will need to include either the applicant’s name or business name, and a complete address that includes the street address, city, state, and zip code.

If you can’t provide a utility bill, you can submit a business tax return, lease agreement, bank statement, billing statement, court documents such as a jury duty summons, Tribal ID, or any other government issued document.

We are unable to accept P.O. boxes and international addresses.

If additional documents to verify your Square-linked bank account are requested, you can submit a copy of your most recent bank statement that shows your full name, the last three digits of your bank account, and current bank transactions.

If you recently opened a new bank account, you can submit a confirmation letter or document showing the opening of the account that shows the business name, account owner name, and account number.

If you are a sole proprietor, the bank account owner’s name must match the name of the loan applicant.

If additional information about a transaction is requested, you can submit one of the following:

- Invoice

- Service contract

- Purchase order

- Signed credit card authorization form

- Detailed receipt

- Bill of sale

- Email correspondence with the buyer

If you do not have any of the above, please provide a detailed description of the goods and/or services sold.

A UCC financing statement is a notice that a lender has a security interest in one or more of your assets. If you’re asked to provide additional information about a UCC lien, we will provide you with the date, filing number, and the name of the secured party. If additional information about a UCC lien is requested, you can submit one of the following documents:

- Payment statements indicating the current status of the underlying loan or obligation

- A letter from the secured party stating that the merchant is current on repayment

- A letter from the lienholder that the loan has been satisfied

- A filed UCC termination statement (UCC-3)

Occasionally institutions use a third party to file, track, and maintain lien positions as the registered agent of the institution. Corporation Services Company is a common third party representative. If you’re unsure of what institution the third party is acting on behalf of, best practice is to reach out to the third party directly.

Upload application documents

- Sign in to Square Dashboard and, go to Banking > Balance > Loans.

- Click Start to upload the requested items.