Refund Overview

Process refunds for payments directly from the Square Point of Sale app or your online Square Dashboard.

Refunds processed through Square on a mobile device must be requested and completed within one year of the original transaction. Payments refunded via your online Square Dashboard can be refunded within one year of the original transaction date.

When you issue a refund, your customer is refunded their full or partial purchase amount, depending on the request. If you included a surcharge in your original transaction, you must refund that amount to your seller.

A team member’s ability to process refunds is determined by their role and permissions.

| Refund Details | Payments |

|---|---|

| Full Refund | Yes |

| Partial Refund | Yes |

| Itemized Refund | Yes |

| Processed more than one year ago via Dashboard | No |

| Processed more than 1 year ago via mobile device | No |

How Refunds Work

Refund Process

Once a refund is initiated, Square will debit the amount of the transaction, and will credit the full purchase amount back to your customer’s card.

The same process applies for partial refunds. The amount you are debited will be proportional to the partial refund amount requested.

You’ll receive email notifications once a refund is requested as well as when a refund completes.

Where will the funds or refund come from?

How you’re charged for refunds depends on your transfer schedule.

If you receive automatic nightly transfers, your Square account balance will be used to cover the amount of the refund and your bank account will be debited for any remaining amount needed. For example, if you have $20 in your Square account balance, Square would take the $20 from your Square account balance and then debit your bank account for the remaining $5 to repay your customer. This activity will be reflected in your Transfer Reports on the business day you processed the refund.

If you have a manual transfer schedule, Square may debit funds from your bank account even if you have a sufficient Square account balance to cover the refund amounts. This will happen when a refund is requested for a payment taken on a prior day. For example, if you have $20 in your Square account balance, but the refund was requested a few days after the original payment was taken, Square will debit your bank account for $25 to repay your customer. Funds removed from your balance to cover refunds will be reflected as an “Adjustment” line item in Activity > All within the Balance section of your Square Dashboard. If a debit to your bank account is made, it’ll appear in Activity > Transfers.

Refund Timeline

Once a refund is initiated, your customer should see a pending transaction on their bank account for the refunded amount within one to three business days. This timeline to post the transaction ultimately depends on the card-issuing bank.

Note: Pending transaction notifications currently apply to payments made with Visa, American Express or Mastercard. Pending transaction notifications will not apply for payments made with other card networks.

The Square full refund time frame typically takes two to seven business days. Once the refund is processed and sent to your customer’s card issuing bank, it can take another two to seven business days (depending on the bank’s processing speeds) for the refund to post to the customer’s account.

Payments processed on Square Online are only eligible to refund within one year.

Note: Refund requests that aren’t covered by your Square balance may not be approved, even if requested within the appropriate time frame.

Declined Refund

If a refund to a payment card is declined, the buyer will automatically be notified about the decline. In this case, you’ll be instructed to issue an alternative form of payment to the buyer to complete the refund, such as cash, cheque, or gift card credit.

Refund Policy

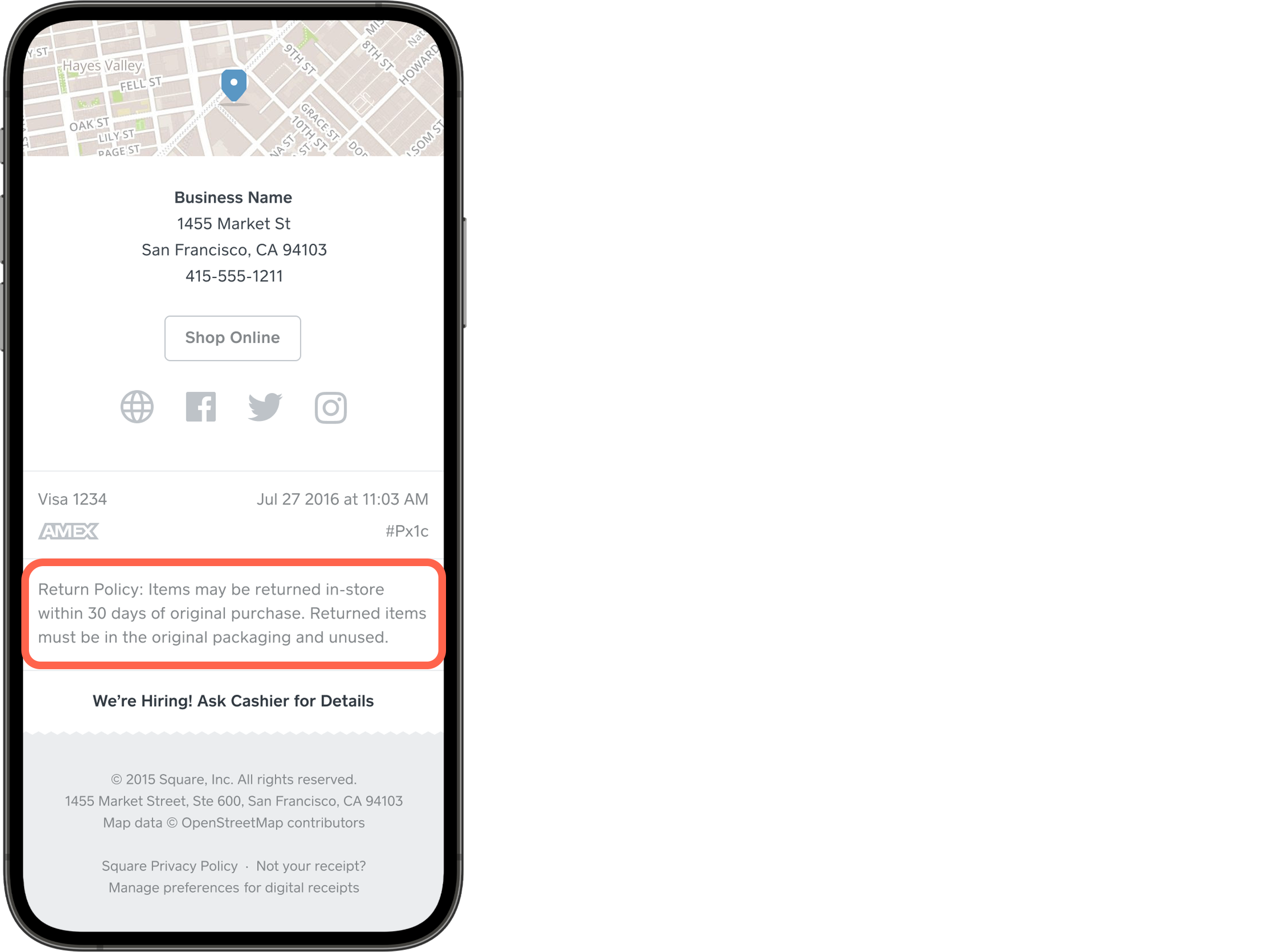

Customize your refund and return policy from the Receipt settings in your online Square Dashboard. Your policy appears in email, text and on printed receipts. If a return policy is absent, it’s assumed there’s no policy. Be sure to clearly state if you don’t offer refunds or warranties.

Note: All major card companies allow cardholders to dispute payments if a customer can demonstrate that they didn’t receive the purchased product or service. Learn how to protect yourself against payment disputes.

Learn more about processing refunds from the Square app or your online Square Dashboard.