Merchant services that answer your business needs

Deciding on a merchant services provider can impact your finances, your operations, and ultimately how you serve your customers. Our fully integrated system of hardware, software, and services can help any business manage payments and risk.

A quick refresh on merchant services

What are merchant services? Merchant services is an all-encompassing term. It describes the hardware, software, and financial services needed for a business to accept and process credit cards and debit cards, NFC-enabled mobile wallets, and other contactless payments — online and in-store.

What is a merchant account?

A merchant account establishes a relationship between a business and a merchant services provider, like a bank. This agreement allows a business to accept credit cards and debit cards, along with other forms of payment. Not all merchant services providers require a merchant account. All you need is a dedicated bank account to process payments with Square.

Why do you need a merchant services provider?

Merchant services providers allow businesses to accept credit, debit cards and other forms of payment online, through a payment card reader, or a point-of-sale (POS) system. Many entities are authorized to be merchant services providers. They generally fall into three categories: banks, independent sales organizations (ISO), and fintech companies like Square.

Our services evolve with businesses in mind

End-to-end payment processing should benefit sellers. That’s why we rethink the status quo.

¹ Instant and same-day transfer require a linked bank account or debit card and costs a fee per transfer. Funds are subject to your bank’s availability schedule. Minimum amount is $25 USD and maximum is $10,000 USD in a single transfer. New Square sellers may be limited to $2,000 per day.

² Square Checking is provided by Sutton Bank, Member FDIC. Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard. Square Debit Card may be used wherever Mastercard is accepted. Funds generated through Square’s payment processing services are generally available in the Square checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues.

Why millions choose Square

Tools and services that scale with your ambitions.

If you’re already established, our suite of tools can help you grow. Keep your business connected with our trusted software, APIs, and software development kits. Security is engineered into all of our products. If you have questions, our support team is available 24/7 to help.

Start taking payments as soon as you say go.

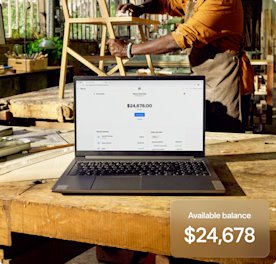

Instantly access, spend, and manage your sales with a free business checking account — included with your Square account.¹

Money for whatever's next.

With Square Banking, your payments, banking, and cash flow can work in sync. Instantly access the money you make on a sale in a Square Checking account. Push forward with a loan tailored to your unique business. Run it all as fast as you need to.

Always know what you pay.

Square’s pricing is always transparent. You pay 2.6% + 15¢ for every tap, dip, or card swipe that happens in person. Online the rate is 2.9% + 30¢ for cards or 1% with a minimum $1 per transaction for ACH bank transfers (invoices only), and 3.5% + 15¢ when you manually key in a transaction.

Consider the total price of working with a provider

Beyond hardware and software, how much are you willing to pay for long-term contracts, PCI compliance, fraud and dispute management, and unexpected fees? Working with banks and ISOs often means paying out of pocket for setup, customer support, and PCI compliance.

You don’t need to sign a long-term contract to work with Square. Rest easy knowing Square complies with PCI standards and can help you mitigate fraud. Our pricing is transparent.

What you see is what you get: processing fees by payment type and no hidden fees ever.

Square

Your choice

- Processing fees

Other providers

- Interchange downgrades

- Rate fluctuations

- Payment terminal lease fees

- Authorization fees

- Gateway fees

- Statement fees

- Chargeback fees

- Return fees

- PCI-compliance fees

- Batch fees

- Early termination fees

- International card fees

- Business card fees

- Non-qualified fees

Custom pricing for your business

If you’re processing more than $250,000 every year, we may be able to design custom pricing packages for businesses like yours. Custom pricing will vary depending on your processing volume, average ticket size, your history as a Square seller, and many other factors.