Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Invoices Manage your services with an all-in-one invoicing software

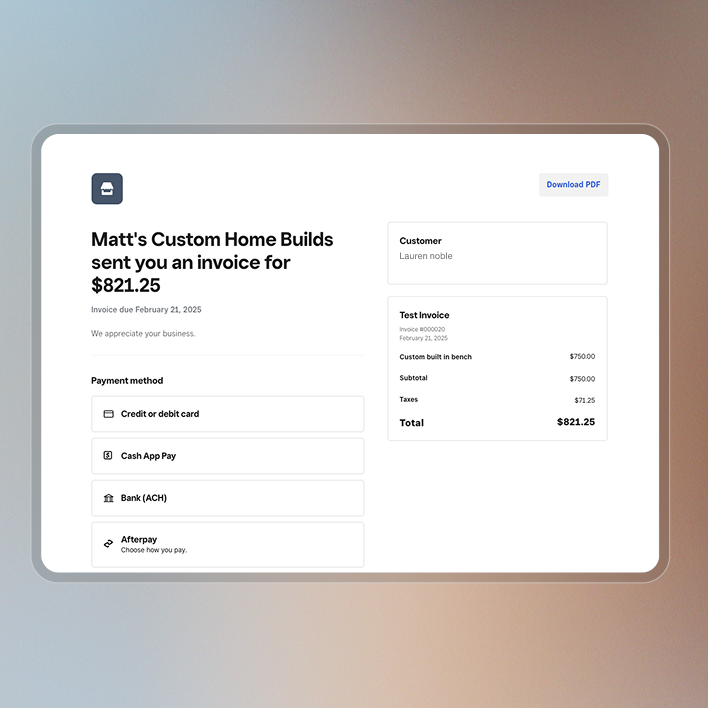

Give customers more ways to pay

Offer multiple ways to accept payments, whether it’s by credit card, Apple Pay, Google Pay, Cash App Pay, ACH bank transfer, or Cash App Afterpay1 — in person or online.

Take in-person transactions and issue refunds

Accept card payments in person and give refunds from your online Dashboard or from the Square POS app.

Get paid remotely

Send digital invoices in seconds via email, SMS, or a shareable link so you can get paid fast by your customers.

Access your funds fast

Transfer funds to your external bank account the next day for free — or instantly for a fee. Access your sales right away with a free Square Checking2 account.

Keep customer cards on file

Save customer payment cards to your customer directory, automate your billing for any invoice, and get paid sooner.

Create automated discounts and taxes

Set taxes and discounts that apply to invoices automatically when you add items or services.

Accept tips from customers

Customers can show their appreciation by adding a tip whenever you send a digital invoice.

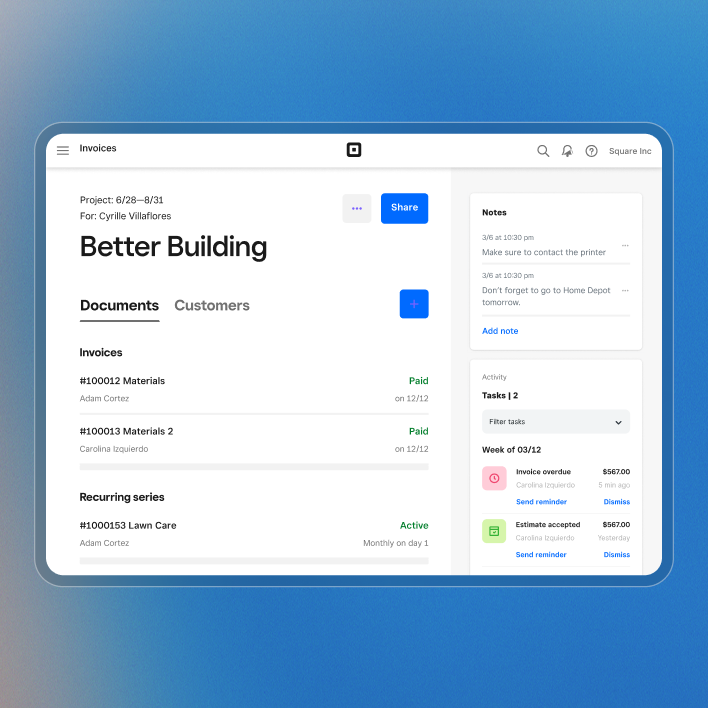

Keep your projects organized from start to finish

Track your project progress every step of the way — from invoice delivery and review to when they're paid — all in real time.

Access everything from one place

See your full project pipeline at a glance. Keep projects organized, share details with customers, and let them review and sign invoices, estimates, and contracts.

Build packages that fit customers’ needs

Give your customers the flexibility to choose what suits them with unique packages of items and services.

Streamline your workflow with editable templates

Take advantage of editable and reusable contract templates — build clauses from scratch, use AI, or adapt prebuilt clauses to fit your needs.

Secure commitments with e-signature

Protect your business and empower your customers with e-signature contracts they can sign from anywhere.

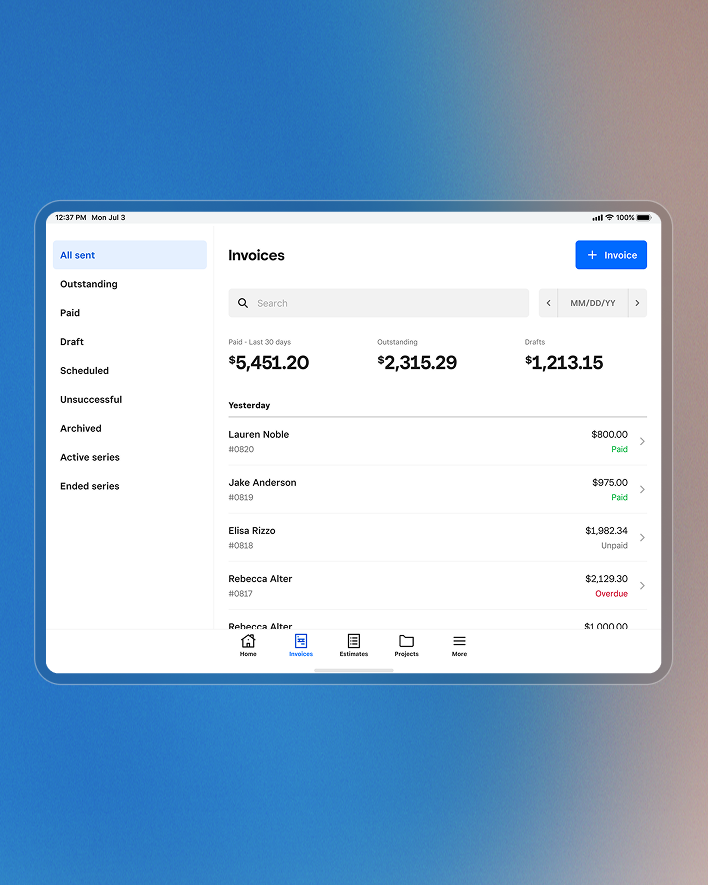

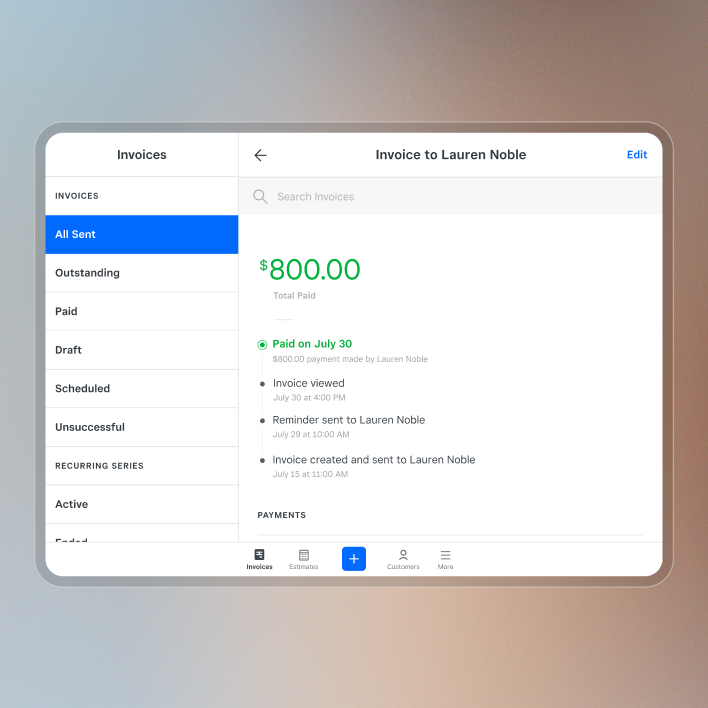

View your invoice status

Know the progress of your invoices at any time to track what’s paid, unpaid, or overdue.

Make data-driven decisions

Master your cash flow with insights across locations, employees, items, services, estimates, invoices, and payments to help make decisions.

Save time by automating your billing

End the hassle of tracking down payments with recurring billing and auto-reminders for upcoming or late payments.

Send deposit requests

Request a deposit to secure your customer’s commitment. Set a separate due date for the remaining balance easily.

Schedule recurring invoices

Set up recurring billing on a schedule that suits your business needs and customer preferences.

Set up automatic payment reminders

Reduce overdue invoices with automatic payment reminders sent before, on, or after the due date.

Create flexible payment schedules

Schedule multiple payments for any job on a single invoice and base payments on specific milestones or phases.

Make billing easier

Simplify your billing with batch invoices by sending one invoice to multiple customers simultaneously.

Turn your estimates into invoices

Convert accepted estimates to invoices automatically and request payment from your customers instantly.

Make your business stand out

Offer professional estimates to clients. Secure business deals by sending contracts with the right context.

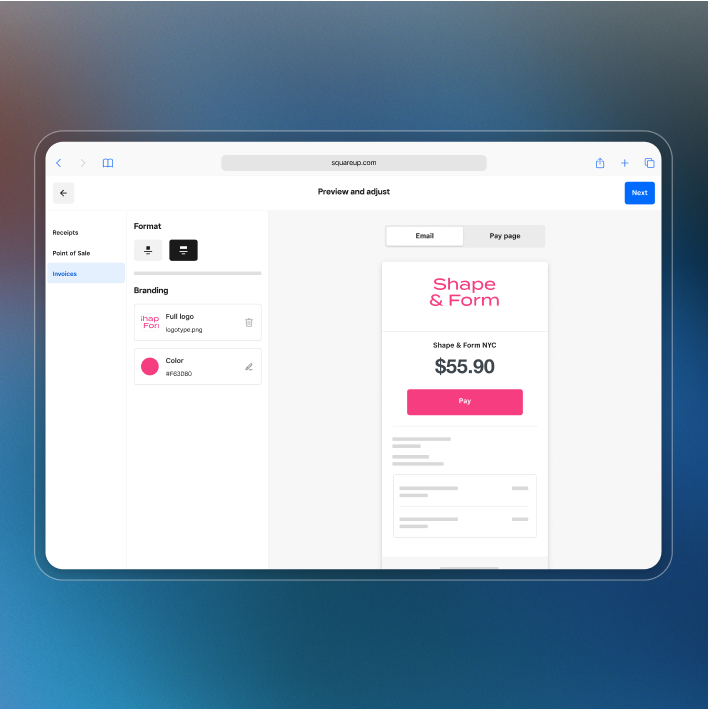

Brand your invoices

Customize your invoices with your business logo and a flexible color scheme to match your brand colors for a professional touch.

Customize your layouts

Create invoices from various layouts and save multiple templates for future use to best fit your business needs.

Build trust with the right context

Tailor your invoices with custom fields — such as terms, policies, and messages — to provide important context.

Create custom contract fields

Enhance your contracts with text fields or questions to capture important client information easily.

Plans for any stage

Free

Everything you need to get paid faster

$0/mo.

+ processing fees

Includes:

Unlimited invoices, estimates, and contracts

Unlimited user accounts

Unlimited customers

Project tracking

Accessible from anywhere

Payment link sharing

24/7 payment acceptance

Plus

Most popular

Continue to grow your business with advanced, time-saving features to streamline work and billing

$20/mo.

+ discounted processing fees

Includes:

Everything in the free plan

Milestone-based payment schedules

Multi-package estimates

Estimate to invoice conversion

Custom invoice templates

Custom fields for invoices and contracts

Batch invoices

Manage all sides of your business

Add hardware that works wherever you do

“Square as a platform is essential to our incredibly complex business environment. The benefits due to the flexibility of the system and the APIs available make it a leader in the point of sale space.”

Mark Stutzman

AREA15

Las Vegas, NV

“In our industry sometimes when you’re in a rural area people think they have to pay cash, but being able to use Square allows us to have more flexibility on the payments side.”

Rudy Temiz

GDNC Nursery & Landscaping

Desert Hot Springs, CA

“The Square Customer Profile tells us every time a customer comes into our shop, how much they've spent with us, and if they qualify for free oil changes through our loyalty program.”

Brandon Cornelius

Costa Oil

Multiple locations

FAQ

How can I send my customers an invoice?

You can create and send invoices in just a few clicks from anywhere at any time, whether it’s on your mobile device with the Square POS app or on any web browser from your desktop.

What methods of payment can my customers use?

You can accept all types of payment methods: cards, cash, checks, and gift cards. Your customers can pay an online invoice through their computer, in person, or from their mobile device with their credit card, Apple Pay, Google Pay, or ACH bank transfer.

How quickly can I access my funds?

You have the option of transferring your sales revenue daily for free, instantly for a fee, or via Square Checking,2 where your money is always available, no transfer needed. With Square Checking, you can access your revenue 24/7 and spend from your Square Debit Card, or account and routing numbers.

How can I automate my billing system?

Square comes with easy-to-understand billing features that help you create recurring invoices and save a card on file to set up auto-billing for any customer. You can also set up automatic reminders before, on, or after a payment due date.

Can I send payment receipts?

Yes, you can send text or email receipts for every type of invoice, no matter the payment method. For recurring invoices, your customers will get a receipt for every payment from the first invoice to the final invoice.

Does your invoicing software offer integration to QuickBooks Online or other accounting software?

Yes, Square offers integrations with the most popular accounting software providers, including QuickBooks Online and Xero. With Square, you're able to seamlessly import payments processed with Square to your accounting software for accurate recordkeeping.

Does Square support multi-currency?

No, Square does not support multi-currency acceptance today.

How can I manage my customers better?

Square comes with a customer management system, Customer Directory, that helps your business store and manage contact information for your customers in one place. You can easily save key details like your customer's business name, email address, and phone number for any business invoice.

Get the job done with Square

1Late fees may apply. Eligibility criteria apply. See afterpay.com for more details.

2Square, the Square logo, Square Financial Services, Square Capital, and others are trademarks of Block, Inc. and/or its subsidiaries. Square Financial Services, Inc. is a wholly owned subsidiary of Square, Inc.

All loans and Savings accounts are issued by Square Financial Services, Inc., a Utah-Chartered Industrial Bank. Member FDIC. Actual fee depends upon payment card processing history, loan amount and other eligibility factors. A minimum payment of 1/18th of the initial loan balance is required every 60 days and full loan repayment is required within 18 months. Loan eligibility is not guaranteed. All loans are subject to credit approval.

Savings accounts are provided by Square Financial Services, Inc. Member FDIC. Accrue annual percentage yield (APY) of 1.00% per folder on folder balances over $10. APY subject to change, current as of 2/18/2025. No minimum deposit is required to open an account. Accounts will not be charged monthly fees. Accounts are FDIC-insured up to $2,500,000. Pending balances are not subject to FDIC insurance.

Square Checking is provided by Sutton Bank, Member FDIC. Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard International Incorporated, and may be used wherever Mastercard is accepted. Accounts are FDIC-insured up to $250,000. Funds generated through Square’s payment processing services are generally available in the Square checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues.